MAGNUM gives you the flexibility to match your account to your goals and your budget

MAGNUM is the ultimate tool for building a large amount of credit

PRO TIP

Pay 2x the amount of the required minimum monthly payment.

- Select an account with a monthly payment that is about half as much as you want to pay

- Each month pay 2x the amount of the required payment

|

MAGNUM |

Required Minimum |

Recommended |

|---|---|---|

| MAGNUM 2000 |

$30 |

$60 |

| MAGNUM 5000 |

$60 |

$120 |

| MAGNUM 10000 |

$125 |

$250 |

| MAGNUM XL 15K |

$175 |

$350 |

| MAGNUM XL 30K |

$350 |

$700 |

MAGNUM IS optimized to build large amounts of credit with a low monthly payment

MAGNUM IS NOT optimized to build savings

Why pay 2x the monthly payment?

MAGNUM SIZED IMPACT

See the large positive impact of additional payments

The smaller your current balance as a % of your original balance the better

Extra payments will give you an account term in the 36 to 60 month range

You’ll pay less interest by reducing the outstanding balance of your credit builder loan faster

MAGNUM is not designed to optimize building savings, but 100% of any extra principal you pay builds your savings

| Savings Built |

2x Min Payment | Minimum Payment |

|---|---|---|

| $500 | 13 Months | 48 Months |

| $1,000 | 24 Months | 79 Months |

| $1,500 | 33 Months | 102 Months |

| $2,000 | 42 Months | 120 Months |

Example for MAGNUM 2000 account $30/mo vs $60/mo (2x) on-time payments. Graphs are for illustration purposes only and individual results may vary based on individual payment activity.

Investing in your credit may be the best investment you ever make

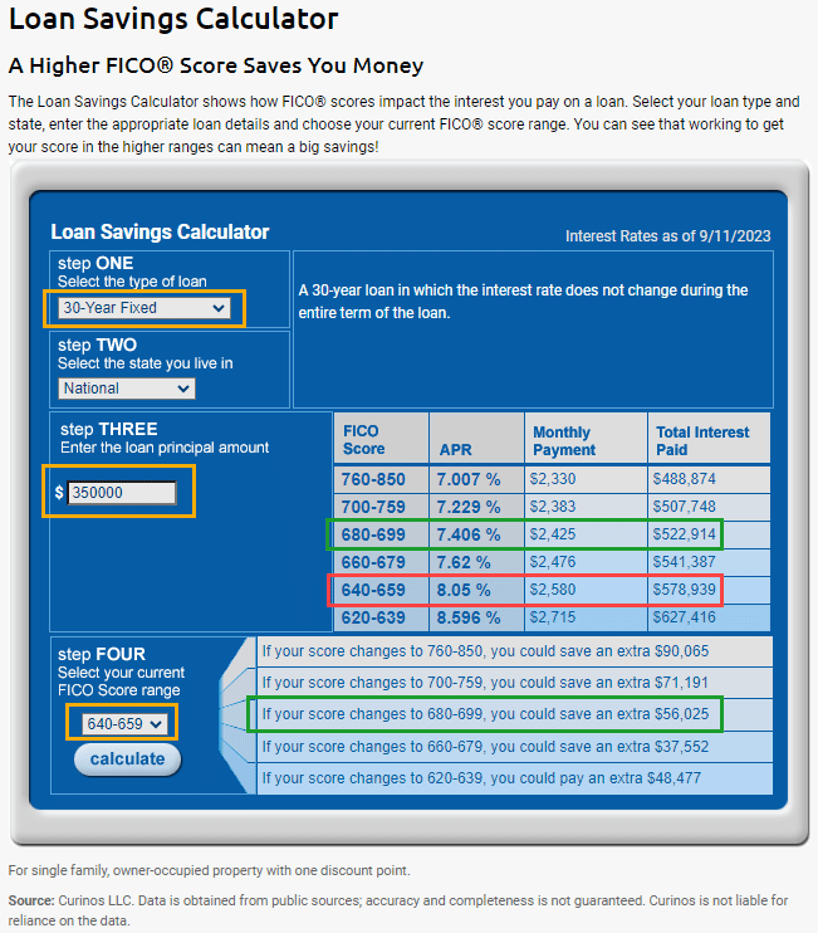

Would you invest $350 to make $56,000?

Example of Potential Interest Savings:

Poor/No Credit (<650 FICO) vs Good Credit (680+ FICO)

Step 1: Starting FICO credit score: 645

- No late or missed payments in the last 12 months

- No open or recent collections or bankruptcy

Step 2: Open a MAGNUM 5000 account and make 12 on-time recommended payments for $120 each

- MAGNUM 5000 accountholder average FICO score increase is 37 points when starting with a FICO score below 650 and making 12 on-time payments

- Click here to see average credit score improvement for MAGNUM accountholders with 12 on-time payments based on starting FICO score

Payment Breakdown: $120/month x 12 months = $1,440

- Your interest expense: $350

- Your savings built: $1,090

Obtain a $350,000 30-year Home Mortgage

after 12 months of on-time MAGNUM payments

|

Before |

After |

|

|---|---|---|

| FICO Credit Score |

645 |

682 |

| Mortgage Interest Rate |

8.050% |

7.406% |

| Monthly Payment (P&I) |

$2,580 |

$2,425 |

| Total Interest Paid |

$578,939 |

$522,914 |

Results

$350 Your investment in building credit – interest you paid on your MAGNUM account

$56,025 Your savings – interest you won’t have to pay on your mortgage

MAGNUM works best when you are ready to start adding POSITIVE payment history to your credit profile

- Recent late/missed payments on other loans or credit cards or open bankruptcy/collections will greatly reduce the positive impact of MAGNUM on-time payments

See details below. Example for illustrative purposes only. Individual results will vary. Credit score improvement is not guaranteed and will be impacted by other factors on your credit profile

We built MAGNUM to magnify the positive impact on your credit profile

MAGNUM:

- MAXIMIZES Amount of Credit reported

- MINIMIZES your minimum required monthly payment

- Provides the MAXIMUM flexibility for ‘Length of Credit History’

How?

We gave MAGNUM a long term (up to 120 months/10 years), with no prepayment penalties, no early withdrawal fees, and the ability to cancel anytime for any reason, penalty-free

Large amount of credit + long term = lower payment + no prepayment penalty = ultimate flexibility

Why?

By minimizing monthly payment and maximizing term, you can customize your account by paying any amount above the minimum required monthly payment or paying just the minimum required monthly payment.

Plan details

Compare making additional payments to making only the minimum required monthly payment using the tables below. Tables include amortization tables, payments, interest rates, interest paid, and savings progress for each account.

Credit Tools

We recommend the MyFico Loan Savings Calculator

The MyFICO calculator can easily estimate potential interest savings you can achieve by improving your credit for different amounts and types of loans.

- Home loans: Fixed-rate, Jumbo, ARMs

- New auto loans

- Used auto loans

Click here to open the MyFICO Loan Savings Calculator

MAGNUM 5000 interest savings example from above